Who needs an FSA-675 form?

This form is filled out by those who want to work in the US Department of Agriculture. The form asks for a lot of information which can be provided to other agencies including the IRS, Department of Justice, etc.

What is the FSA-675 form for?

This form is an application for a job in the Farm Service Agency (FSA). The applicants complete all the fields of the form and answer all the questions. The data provided is forwarded to the FSA, where it’s used to figure out whether the candidate is eligible for the specified position. The applicant has the right to omit some fields of the application.

Is the FSA-675 accompanied by other forms?

The applicant can attach the requisite certificates and documents.

How long does it take to fill the form out?

The approximate time of filling out the form is an hour. The applicant should file the information as soon as the desired vacancy appears.

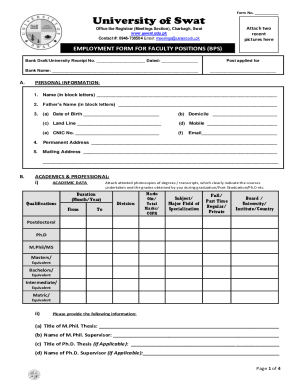

What information should be provided in the FSA-675 form?

The application serves as a detailed resume, that’s why it asks the applicant for a lot of information. The filler has to provide the following data:

- State and county of living

- Position applied for

- The lowest acceptable salary

- Number of days notice required before reporting to duty

- Name, address, SSN, phone number, place of birth

- Criminal background

- Information about the relatives working in the US Government, the US Armed Forces or any County FSA Office

- Information about the education

- Information about the military service

- Information about the farm/agribusiness experience

- Work experience: date of employment; name and address of employer; hours per week worked; reason for leaving; description of work)

The applicant should sign and date the form as well.

What do I do with the form after its completion?

The completed application is filed with the FSA County Office.